One of the most important concepts to understand in the stock market is risk. Someone might say that a stock is going to go up a million percent. The key word here is might. What if it doesn’t? What are you risking?

As an investor and trader, it’s important to understand your risk as well as your reward. Even if you do extremely detailed research, there’s still a chance that something may not go your way. The best way to protect yourself against excessive risk is to hedge. Hedging is protecting yourself from losses by trading other securities to reduce losses. Think of it like insurance. The best hedge is when you buy a stock and short it at the same time. No matter what direction the stock moves, you will always make $0. You are incurring 0 risk. This is problematic though, as you want to make money. No matter what trade you make, as long as you are trying to make money, there is always the chance that you lose money.

Stocks are pretty bad at protecting you from risk. Although there are ways to hedge against risk by purchasing multiple stocks, if you are only buying one stock, there isn’t much you can do to protect yourself. If the stock goes up a lot, then good job. If the stock goes down a lot, then you risk losing a substantial amount of money. Making money from just stocks is very one dimensional; if you think the stock is going to go up only a little bit, you won’t be able to make more money from that.

Options give you a way to protect yourself and also allow you to profit with less risk in specific situations. We have already seen how a normal call option protects you from large losses, as you have the right, but not the obligation to buy the underlying at the strike price. These contracts can be combined together, to give you less risk and more profit. Each contract is called a leg, and the legs combine to form a strategy.

A few common strategies are below, but we encourage you to use our simulator and build out these strategies yourselves to see how they work.

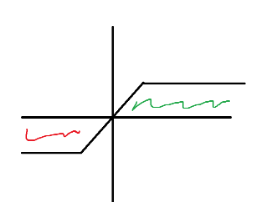

Call debit spread:

This spread comes from buying a call and selling a call with a higher strike price. Based on the profit and loss chart, you can see your losses are capped and your gains are capped. If you think that a stock will only go up a certain amount in a certain timeframe, you don’t gain anything by buying a normal call, as you think the probability of the stock increasing a lot is very small. In this case, you sell the possibility of unlimited upside for “insurance” to protect some of your downside.

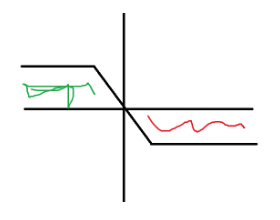

Put debit spread:

Similar to the call debit spread, except this spread has you profiting when the stock goes down rather than up. Here, you are selling a put and buying a put with a higher strike price. If you think the underlying is going to go down a specified amount in a certain amount of time, again, there is no gain to buying a normal put contract, as the possibility of unlimited gains is pointless (to you). Instead, you sell that possibility for some “insurance” to protect yourself if the stock goes up.

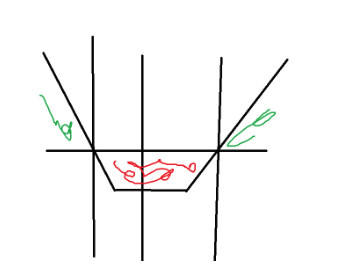

Long Strangle:

Looking at the profit and loss chart, we can see that you profit when the stock makes large moves in either direction. This strangle is made when buying a put and buying a call. If you know that a stock is going to move a lot, but you are not sure in which direction, this strangle gives you more flexibility to make a better trade.

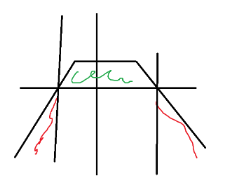

Short Strangle:

This is the opposite of the long strangle, as you profit if the stock doesn’t move. Here, you are selling a call and a put. If you think that the underlying is going to stay around the same range, you can profit using this strategy.

Using these strategies, you can find unique ways to profit that aren’t possible with traditional stocks. Make sure to use the simulator to make your own strategies.