Let’s start simple.

The foundational way for someone to make money in the stock market is to buy low and sell high. This type of thinking exists everywhere. Companies want to increase revenues and reduce costs. In movies, Wall Street traders buy stocks and watch as the line goes up. People think like this because it’s easy; you don’t have to have a degree to figure this out. If I buy LemonadeChains stock at $100, and I sell at $101, I’ve made $1. Buy low, sell high.

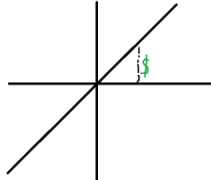

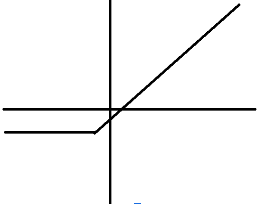

A good way to picture this is with a profit and loss chart. On the x-axis, we plot the change in the stock’s price after we bought the stock, and on the y-axis we plot how much money we make.

Using the above points, we can get a PnL chart that looks like this:

As we noted before, if I buy low and sell high, I make money. If I buy high and sell low, I lose money. From the graph, we can also see that we make money in proportion to how much the stock moves. If LemonadeChains stock goes up $1, then I pocket $1 when I sell.

Buying and selling stocks the standard way works well when you think a stock will go up a lot and stay up. But what if I think the stock isn’t going to move at all? What if I think the stock will move a lot, but I don’t know which way it will move? What if I think the stock will go up just a little bit? What if I think the stock will go up a lot, but I notice that the stock is very risky?

All of these questions can be answered with the flexibility of an options contract. An options contract will allow you to make money in different situations, not just when the stock goes up a lot.

Think of an options contract as a contract. It is a piece of paper with several points written on it. When the buyer buys the contract, they “sign” the contract, and so does the seller when they sell the contract. By “signing” the contract, they both agree to the points written on the contract.

The points on the contract are as follows:

1. The buyer of the contract has the right but not the obligation to buy 100 shares of a certain stock at a predetermined price. The seller must provide the buyer with those shares at that price if the buyer exercises that right. If the buyer does not exercise that right – as they do not have the obligation to do so – the seller does not have to provide the shares.

2. The contract will expire at a predetermined date. The buyer can exercise their right any time up until expiry.

You can see now where options contracts get their pricing from. Similar to the stock market where if there’s more demand than supply for a stock the stock price will go up and vice versa, a contract’s price is also affected by supply and demand. If a lot of people want the right to buy a stock at a certain price, then the price will go up. If people don’t want that right, then the price will go down.

Something that makes options contracts unique is its ability to expire. This is partly because no one would agree to a contract indefinitely, because someone could just wait a very long time until the stock finally goes above the agreed upon price. With a deadline in place, both sides will have a more equal approach. Different contracts have different expiry dates, which leads to different pricing and values.

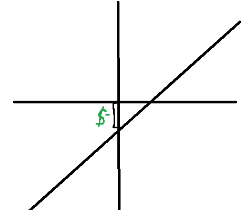

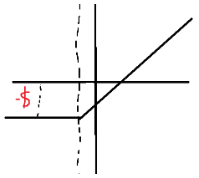

Using the above points, we can get a PnL chart that looks like this:

At first, this graph might feel intimidating. Why are my losses capped? Why do I lose money if the stock doesn’t move?

Looking back to the above points we can make sense of the graph. First off, we paid a certain price for the contract. This automatically shifts the original stock chart down by the amount we paid.

Since we have the right, but not the obligation to buy a stock at a certain price, we would never use that right if the stock price was below that value; we could just buy the stock at market price without the option. That means that if the stock goes down a ton, we will only lose the amount we paid for the contract.

The point where the line turns from horizontal to positive slope is where the previously agreed to price is. At that point, it becomes more worth it to buy the stock at the agreed upon price than to buy at market price. If the price of the stock is just above the agreed upon price, you will still be losing money on this contract because the difference between the actual and agreed upon price is smaller than the price you paid for the contract in the first place.

At a certain point, the difference between actual and agreed upon price becomes greater than the amount of money that you paid for the contract, and you start making money. Each contract has a different point where you break even.

There are different ways for you to “make money” on an options contract. Similar to how you don’t actually “make money” until you sell a stock, there are multiple things that you can do to get a profit (or a loss) on your position.

The first way is to use your right to buy the shares at a certain price. Let’s say you bought a contract where you have the right to buy a stock at $100. The price now has risen to $200. You could use that right that was stated in your contract to buy the stock at $100, which is effectively a 50% discount. You can use this right anytime until your contract expires.

A similar method would be to wait until your contract expires, and then if the agreed upon price is below the current price, your contract will be automatically exercised and then sold. Using the previous example, instead of you owning shares at the purchased price of $100, you “buy” the shares at $100 and then immediately “sell” them at $200. Buy low, sell high.

Another way you can make money is by just selling the contract itself. Contracts are like pieces of paper that can be bought and sold. When you bought your contract, someone sold it to you. Likewise, if the price of the stock continues to rise and your right but not the obligation to buy the stock at a certain price becomes more valuable, you can sell it to someone else who wants to use that right. Buy low, sell high.

That’s the basic anatomy of an options contract.